》Click to View SMM Spot Aluminum Prices

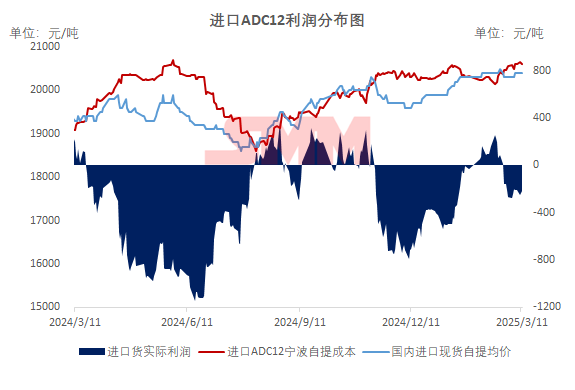

【Overseas Prices Remain Firm, Import Window Remains Closed】The most-traded SHFE aluminum contract opened with a sharp decline today, with the price center continuing to move downward. SMM A00 aluminum prices dropped by 60 yuan from the previous trading day to 20,710 yuan/mt, while secondary aluminum prices remained mostly stable. Domestic SMM ADC12 prices held steady within the range of 21,200-21,400 yuan/mt. In the import market, overseas ADC12 prices remained firm at a high level near $2,500/mt, with real-time import losses staying at 200-300 yuan/mt, keeping the import window closed. Aluminum prices continued to drop slightly today, with most secondary aluminum plants maintaining stable quotes, while some companies reduced prices by 100 yuan/mt. Current market demand is weaker than expected, with orders rebounding slowly, limiting the upside room for ADC12 prices. As raw material market liquidity improves, cost side support is weakening further. If the recovery in end-use consumption lacks sustainability, coupled with further loosening of cost support, ADC12 prices may continue to face downward pressure.

Note: Import profits refer to real-time profit